Various terms used in the stock market

Before we get started, you will encounter different terms in the stock market. Don’t worry about knowing every single one of them already or how to look them up. There are lots of websites that give this information pre-made in a well organised manner . But it’s still useful to have a basic understanding of how it works.

- Few websites: NSE India, money control, screener etc..,

LTP (Last Traded Price)

LTP is the last traded price of a stock during trading hours.

OHLC (Open, High, Low, Close)

- The opening price is the price at which a stock opened when the opening bell rang at 9:15.

- The high price is the maximum price at which the stock traded in a given trading session.

- Low price is the lowest price at which the stock was traded in a specific trading session.

- Closing price is the price of a specific stock when the day’s stock exchange closes.

- How opening price is fixed: Opening price is determined by the pre-open market session and AMO (After Market Order) orders.

Gap Up and Gap Down Opening

- Gap up: If the price of the share opens higher than yesterday’s closing price then it is a gap-up opening.

- Gap down: If the price of the share opens lower than yesterday’s closing price then it is a gap-down opening.

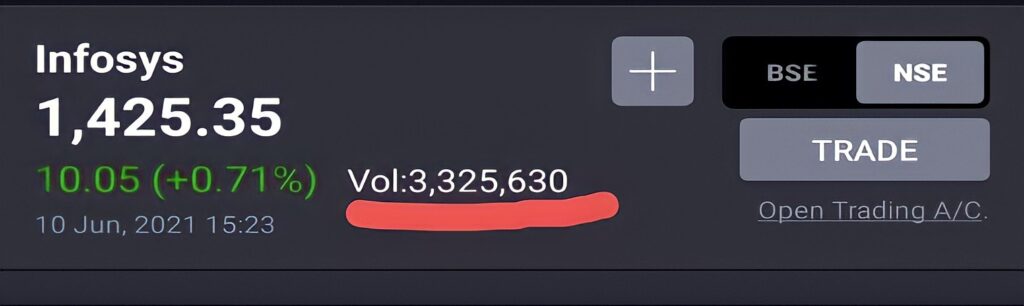

Volumes

Volume simply means the total amount of buyers and sellers who exchange shares during a specific period.

- In the above example of Infosys, 3,325,630 shares were traded on a given day.

Market Trend

A market trend simply means the direction in which the market is headed. There are primarily three types of trends:

- Uptrend: Rising price movement where the stock forms higher highs and higher lows.

- Downtrend: Falling price movement where the stock forms lower highs and lower lows.

- Sideways: Price fluctuates in a range, highs and lows stay in the same range.

Share Capital & Market capital ( or capitalization)

Share capital is the real value of the company.

- It is determined by multiplying the number of shares with the face value .

Market cap defines the size of the company based on its wealth.

- It is determined by multiplying the number of shares with the current market price per share

- Large cap: More than 20,000 crores of market capitalization. Such stocks are also known as blue-chip stocks.

- Midcap: 5,000 crores to 20,000 crores of market capitalization.

- Small cap: Less than 5,000 crores of market capitalization.

Usually, everyone feels large-cap stocks are safe compared to small-cap stocks. But there is also a chance for greater growth in small-cap stocks in the future.

Equating Stocks with Trees

- A large established company (like a giant redwood tree) is stable but has limited growth potential.

- A small company (like a young oak tree) has high growth potential but is riskier. High

- risk = High returns; Low risk = Safe returns.

Example from the book “Stock Investing for Dummies”

Free Float Market Capitalization

The free-float way of determining market cap does not consider locked-in shares (promoter shares). Promoter’s shares are not available in the market as they are held only by promoters and do not change hands in the market.

Thus, the free float is of the shares floated to the public and only these shares change hands. Therefore, they are referred to as free-float shares.

- It is done by taking (number of freely floating shares) × (market price per share).

Bearish & Bullish Markets

- Bullish Market: When the market is expected to rise.

- Bearish Market: When the market is expected to fall.

Why Bull and Bear Market?

- A bull attacks its enemy by lifting its head in an upward direction with its horns. Thus, when the market goes up, it is referred to as a bullish market.

- A bear attacks its rival by dragging it down. Thus, when the market goes down, it is referred to as a bearish market.

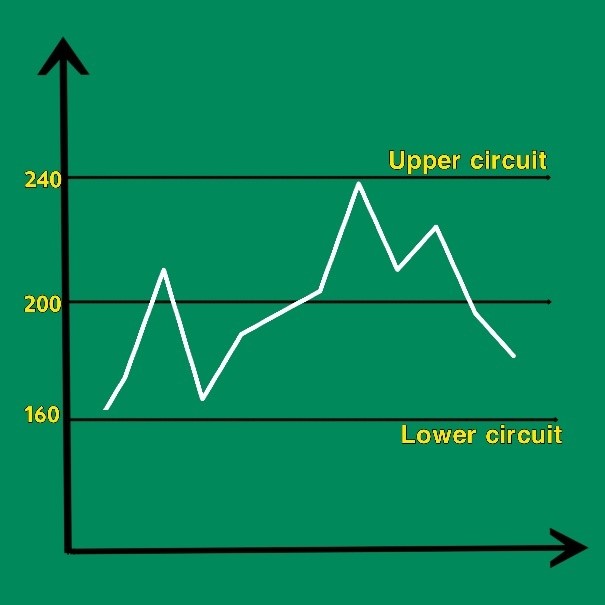

Circuit Filter/Breaker

It is an amount above which a stock price cannot increase or decrease on a given day.

- Typical circuit filters include 5%, 10%, and 20%.

- Stock exchanges implement circuit filters according to SEBI guidelines to avoid a sharp drop or rise in the price of stocks and to protect against volatility.

Example, the opening share price of a firm is Rs 200 and it has a circuit breaker of 20%,

- The upper circuit will be Rs 240

- The lower circuit will be Rs 160

- On day two, 20% will be computed on the closing price of the previous day.

Upper circuit: The highest price up to which the share price cannot move higher in one day. (There will be a lot of buyers and limited sellers in this case.)

Lower circuit: The lowest price up to which the share price cannot fall on one day. (There will be a lot of sellers and limited buyers in this case.)

Bulk Deal & block deal

- Bulk deal is a transaction in which the collection quantity purchased or sold exceeds 0.5% of the company’s total equity shares.

- Block deal is a transaction on a minimum of 500,000 shares or minimum value of Rs 10 crore done through one transaction on the stock exchanges.

The stock exchange has to publish all the block deal-related information to the general public on the same day post-market hours.

Market Index or Indices

It is not feasible to track every single company listed on the stock market and there are thousands of companies listed. Due to this reason, stock market indices were formed, they serve as a report card for the market.

In short terms, a stock market index is a group of stocks in various sectors and industries. It typically reflects the whole market.

- A stock index indicates the overall market attitude and price change.

- When the prices of the majority of chosen stocks move up, the index will go up.

- When the prices of the majority of chosen stocks come down, the index will drop.

There are two main stock exchanges in India:

- The Bombay Stock Exchange (BSE) : Its leading index is SENSEX and consists of the top 30 companies.

- The National Stock Exchange (NSE) – Its leading index is NIFTY and consists of the top 50 companies.

Both the indices are market capitalization-based and consist of shares of heavily traded companies from leading sectors. Indices assist investors in determining market health and sentiment.

Sectoral indices represent a particular sector and follow their movement. Example,

- Bank Nifty consists of banking companies;

- Nifty FMCG consists of FMCG companies.

- Nifty IT consists of IT companies.

Note: If the Sensex, Nifty or sector index increases, it does not indicate that all stocks in that particular index are increasing. Some stocks might increase, and some might decrease.

Who Determines the Stock Price?

Stock prices are decided by the law of demand and supply.

- When a large number of investors desire to purchase a stock, its price goes up.

- when large numbers of individuals sell a share, its price goes down.

- The value of a share fluctuates because millions of investors buy and sell every minute.

Mastering these terms is another step toward your investing journey.

Summary

- Market Trends: Stocks follow trend towards uptrend, downtrend, or sideway movement.

- Market Cap & Free Float: Assists in categorizing companies as large cap, mid cap, or small cap depending upon valuation.

- Bull & Bear Market: In a bull market, prices appreciate and decline in a bear market.

- Circuit Breakers: Restricts abnormal stock price action to prevent volatility.

- Stock Indices: Sensex and Nifty show overall market performance.

- Price Determination based on demand and supply in the market.