Types of orders in stock market

When trading stocks, there are different types of orders you can place when buying or selling a stock. Understanding these order types helps in better execution and clarity.

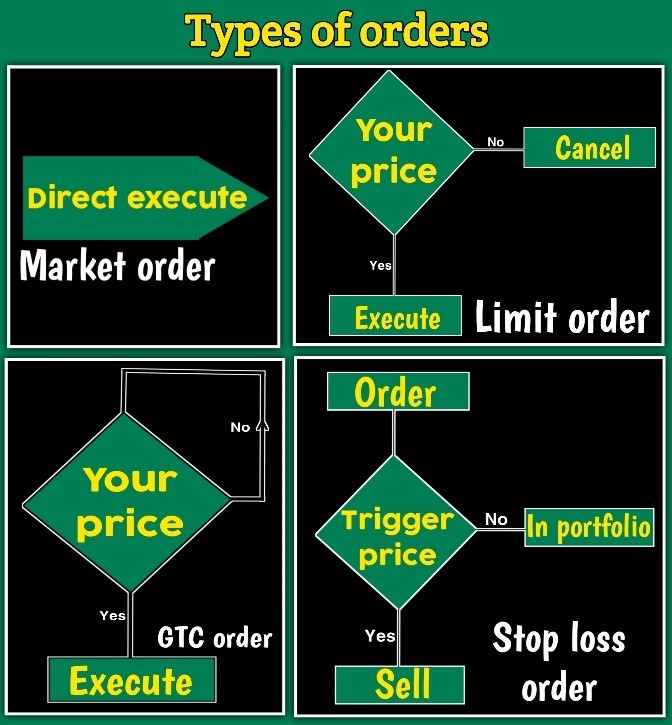

Market order:

This is the most basic type of order. A market order is a quick buying or selling order that gets executed at the current market price. Here, order ensures immediate execution but does not guarantee a specific price. This order is the fastest and most reliable way to get in or out of a trade.

Example:

- If a stock is trading at Rs. 1000 and you place a market buy order, it will execute at the best available price, which may be Rs. 1000 or slightly higher.

- If you place a market sell order, it will be executed at the best available bid price.

Limit order:

A limit order is where the investor bargains and does not offer to buy/sell at the current market price. It offers the user to set a specific price at which they are willing to buy/sell a stock. it will only be filled if the price reaches the specified limit set by the user. Generally,

- Limit Buy Order: the trader intends to buy a share below the market rate.

- Limit Sell Order: the trader intends to sell a share above the market rate.

Example:

- If a stock is trading at Rs. 1000 and you want to buy it at Rs. 990, you can place a limit buy order at Rs. 990. The order will execute only if the price drops to Rs. 990.

Stop Loss Orders:

A stop-loss order is an order to sell a stock when its market price reaches or falls below a specified level (trigger price). A stop-loss order helps the user limit their losses. This feature is mostly used by intraday & swing traders.

Example:

- If you buy a stock at Rs. 1000 and want to limit your loss to Rs. 950, you can set a stop-loss sell order at Rs. 950. If the stock price reaches 950, your order will be triggered, and the stock will be sold automatically.

GTC Order (Good Till Cancelled):

This is used when an investor wants the pending order to remain active until he/she manually cancels the order or it gets executed when the market price breaches the limit price.

Example:

- If a stock is at ₹1000 and you place a GTC Buy Order at ₹950

- If the stock price falls to ₹950, the order will be executed automatically.

- If the price never reaches ₹950, the order will remain active until the investor cancels it manually or the broker’s policy cancels it after a certain period.

GTT (Good Till Triggered):

It is a conditional order that gets activated only when a predefined trigger price is met. If the trigger condition is met, the order is executed; otherwise, it remains inactive until it expires.

Example:

- If an investor places a GTT buy order at Rs.990, where the current price is Rs.1000, the order will stay in the order book. It will be executed when the stock price reaches Rs. 990.

- GTT orders typically have a validity of one year.

After Market Orders (AMO):

AMO is similar to a normal order, except that it is placed after regular market hours. These orders are executed when the market opens the next trading day. Different brokers specify a time interval within which AMOs can be placed.

IOC Order (Immediate or Cancel):

This is an order where the investor wants to immediately execute their buy/sell order and if it is not executed immediately, the order is cancelled.

Intraday Trading (Day Trading):

Intraday trading is the practice of buying and selling stocks on the same day, and they will be automatically sold at the end of the trading session by the broker, if you have not sold them yourself during the trading session.

Important points For beginners,

- intraday trading carries high risk and requires constant analysis and monitoring.

- It requires skill, discipline, and quick decision-making. However, it can be rewarding with proper strategies and risk management.

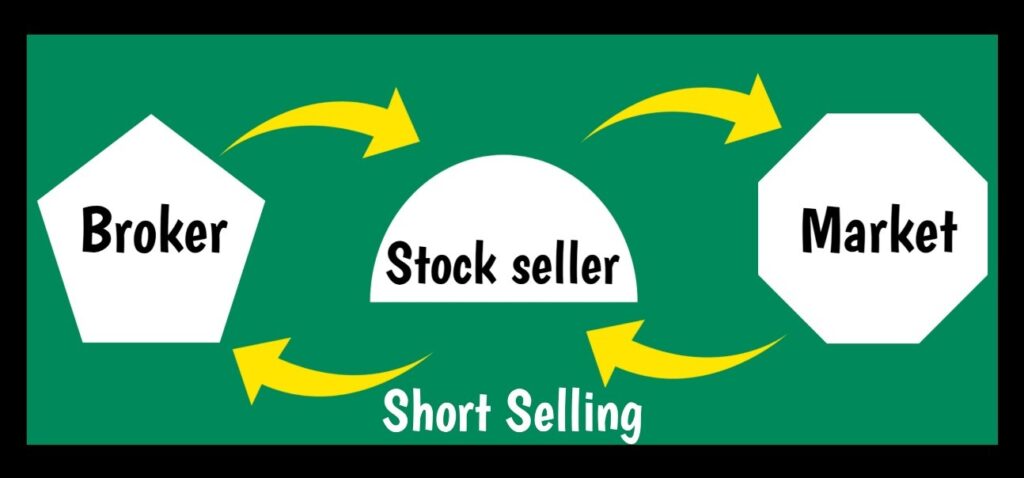

Short Selling:

Buying at low and selling at high is not the only strategy to make profits in financial markets. SHORT SELLING is a technique for earning profits in falling markets. Short selling refers to selling stocks without owning them.

How does it work?

- Traders borrow shares from a broker.

- Sell them at market price, hoping that the share prices will drop within the same day.

- If the price drops, the trader buys them back at a lower price.

- Returns the borrowed shares to the broker and keeps the profit.

Example:

- If a stock is trading at Rs. 1000 and you believe it will fall, you can short sell at Rs. 1000.

- If the price drops to Rs.990 you buy it back, making a profit of Rs.10 per share.

Note:

If you perform a short sell, you must buy back the sold quantity before the market closes. otherwise, it leads to a penalty.

- Short selling has similarities with intraday trading but differs in actions because the sell and buy back transaction must be completed on the same day

Note: In Limit, GTC, and GTT orders may trigger at the specified price but might not get executed due to factors

- low liquidity,

- price fluctuations,

- lack of matching buyers/sellers or price gap-up/gap-down movements.

Each order type has its advantages and it should be used based on market conditions and individual trading goals.