Rise & fall of sovereign gold bonds

The Curious Middle Class Investor in 2015

It was 2015, gold prices were oscillating wildly and physical gold was losing its shine due to making charges, theft risks and lack of liquidity. A cautious middle class investor, unsure about mutual funds and not ready to store gold at home, came across a new offering: the sovereign gold bond scheme.

It sounded too good to be true government backed, 2.5% fixed interest and no storage hassle. But was it really the smartest gold investment Indians could make or a ticking time bomb for the government?

What are sovereign gold bonds?

Sovereign gold bonds (SGBs) are government securities released by the Reserve bank of India (RBI) in support of the government of India. They are denominated in grams of gold and offer the dual benefit of capital appreciation (linked to market gold prices) & fixed interest income.

They were launched in November 2015 under the Gold Monetisation Scheme to reduce India’s dependence on physical gold imports, improve financial savings and offer a more efficient, paper-based gold investment alternative.

Why SGBs were a game changer

- Sovereign guarantee: Fully backed by the Government of India.

- Assured returns: A steady 2.5% interest per annum over and above gold price appreciation.

- Tax benefits: No capital gains tax on redemption after 8 years.

- Digital ownership: No worries about theft, storage or purity.

- Affordable entry: Minimum investment was 1 gram & maximum up to 4 kg/year for individuals.

“SGBs were a strategic move to reduce gold imports and develop paper based gold savings,” – RBI, 2022.

Since launch, over ₹72,000 crore has been raised through 67 tranches, covering 147 tonnes of gold.

Remarkable Returns Achievement

Early investors in SGBs were richly rewarded. The first SGB back in November 2015, each gram cost just ₹2,684. Fast forward 8 years, and that investment gave you around 128% returns that’s roughly 12% per year, even after taxes. That’s not just “good”, that’s better than most FDs, mutual funds or even many stocks.

This wasn’t a one time chance:

August 2016 Series I: Bought at ₹3,119 → 118% gain

January 2018 Series XIV: Bought at ₹2,831 → 240% gain

January 2019 Series IV: Bought at ₹3,119 → 209% gain

All of this with zero storage risk, tax-free capital gains (if held till maturity) and a guaranteed 2.5% annual interest sprinkled on top. Sounds like a sweet deal, right?

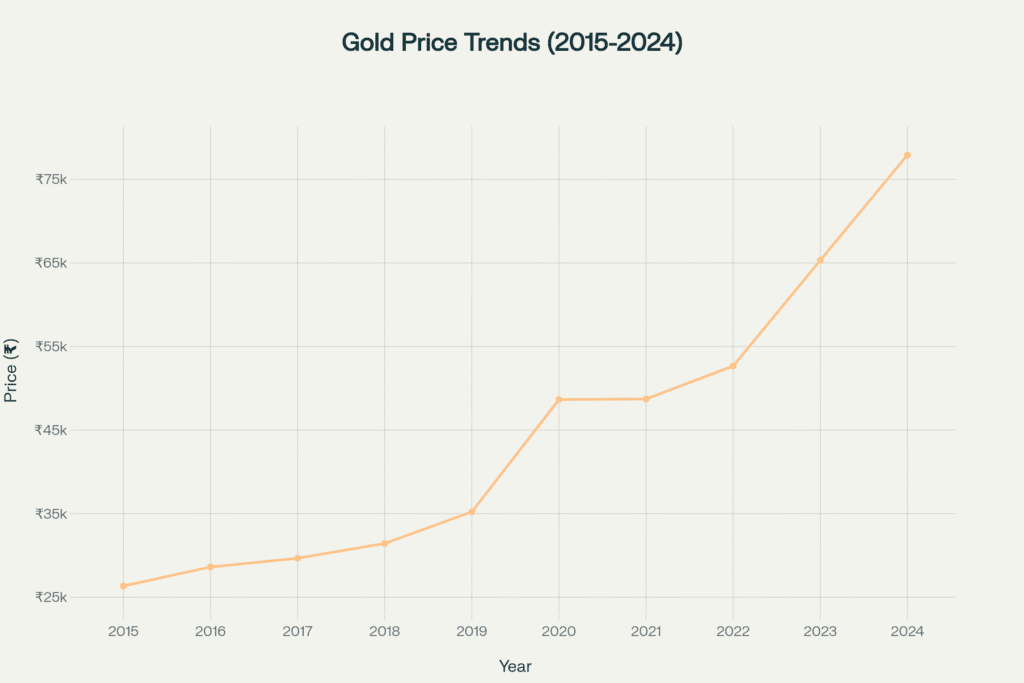

Gold Price Appreciation Context

The stellar performance of SGBs is intrinsically linked to gold price appreciation in India. Gold prices have experienced dramatic growth over the past decade

In 2015, gold was around ₹26,343 per 10 grams. By 2024, it touched nearly ₹77,913 almost 3 times in under a decade! A big part of this spike came after 2020, due to:

- Global uncertainty during the pandemic

- Concern about inflation and recession

- Weakening currencies and people rushing to safe haven assets like gold

In short, those who trusted gold and more importantly, trusted SGBs were rewarded handsomely.

SGBs vs Gold ETFs vs Physical Gold

| Feature | Sovereign Gold Bonds | Gold ETFs | Physical Gold |

| Ownership Format | Paper/Digital | Demat | Physical |

| Interest Earned | 2.5% p.a. (fixed) | None | None |

| Capital Gains Tax (on maturity) | Exempt for individuals | Applicable | Applicable |

| Purity Concerns | None | Low | High risk |

| Storage Cost | None | Demat charges | Locker/making charges |

| Tradability | Medium (secondary market) | High | Low |

🛑 Why Was the Scheme Discontinued? (the fall)

In 2024, the government announced a big decision that the issuance of new sovereign gold bonds would stop. February 2024 saw the last batch being released, bringing an end to an 8 year streak.

But why stop such a popular scheme?

According to finance minister Nirmala Sitharaman, the main reason was cost. When SGBs were first launched in 2015, they were a smart move encouraging digital gold savings and reducing the need to import physical gold. But over time, things took a turn.

Here’s what went wrong:

- Gold prices kept going up and up, which meant the government had to pay a lot more at maturity.

- They also had to pay 2.5% interest every year to investors, no matter what.

- Compared to other ways the government borrows money (like treasury bonds), SGBs became very expensive.

So, the scheme that once saved money, started costing a lot.

A Quick Look at the Numbers:

- In 2017–18, the government owed around ₹6,664 crore under this scheme.

- By 2023–24, that number shot up to ₹68,598 crore: a 930% increase!

- By March 2025, the total repayment burden hit ₹1.2 lakh crore for 130 tonnes of gold still in circulation.

In total, the government had raised about ₹72,000 crore through 67 tranches since launch.

That’s a lot of money to manage especially when gold prices are unpredictable.

“SGBs turned out to be expensive for the government due to their guaranteed return structure,” – Economic Affairs Secretary, Ajay Seth.

So, What Does This Mean for You?

If you already hold SGBs, don’t worry. Your bonds are still safe. You’ll continue to get the 2.5% interest and your money back at maturity. But for new investors, this door is now closed at least for now.

Still, the story of SGBs teaches us something important: even government schemes need to balance profitability and practicality.

Alternatives to SGBs now

| Option | Pros | Cons |

| Gold ETFs | Liquid, real-time trade, SEBI-regulated | No interest, subject to fees |

| Gold Mutual Funds | Easy SIP investment, diversification | Expense ratio, exit loads |

| Digital Gold | Small investment, instant buy/sell | No regulatory like sebi |

| Physical Gold | Tangible, cultural value | Storage, making charges, purity doubts |

The legacy and what’s next

The SGB scheme helped modernize gold investment in India:

- Introduced digital gold ownership.

- Reduced gold imports.

- Made gold an income generating asset.

But it also shows the risks of linking guaranteed interest with volatile commodities.

Going forward:

- Expect growth in tokenized gold, ETFs and mutual funds.

- Investors should focus on liquidity, tax and cost structure.

Conclusion: key takeaways

- SGBs offered safe, high yield gold exposure to long term investors.

- The scheme’s returns outpaced traditional assets.

- Tax efficiency and government backing made it unique but also costly for the nation.

FAQ

No. New issues have been paused since Feb 2024. You can buy from NSE/BSE.

Yes. 2.5% annual interest is added to your income and taxed per slab.

Yes, only if held till maturity (8 years). Early redemptions are taxable.

Yes, after 5 years on interest payout dates. But early redemption may attract capital gains tax.

Mainly due to high cost of borrowing, growing liabilities, and policy shift.

Try Gold ETFs for liquidity, or gold mutual funds for long-term exposure.

For long-term investors, SGBs were better due to fixed interest and tax-free maturity. Now, ETFs are more liquid

There’s no official word, but if fiscal conditions improve, the government might reconsider.

Related reads:

Sukanya samriddhi yojana 2025: returns, rules & benefits explained

Provident funds in India: A simple guide for long term savings