Power of compounding: Grow your wealth smarter & faster

Have you ever wondered how some people multiply their money without doing much? The answer often lies in one powerful concept : compound interest. In this blog, we’ll explore the benefits of compound interest over time with relatable examples, helping you understand how to make your money work smarter.

What Is Compound Interest?

Compound interest lets you earn profit (interest) not just on your principal but also on the profit (interest) you’ve already earned. This creates a snowball effect, the longer your money stays invested, it grows quicker.

Example: if you invest ₹1,00,000 at 10% annual interest. In one year, it grows to ₹1,10,000. Next year, the 10% applies to ₹1,10,000 – not just your original ₹1,00,000. This cycle keeps repeating.

That’s the magic of compounding!

Simple Yet Powerful Example

Let’s assume you invest ₹5,00,000 at 8% interest annually:

After 1 year: ₹5,40,000

After 5 years: ₹7,34,664

After 10 years: ₹10,79,462

No extra deposits. Just the original investment working quietly in the background. This is why long-term investments in mutual funds or any investment that offers compounding are often encouraged.

Why Time Is Your Best Friend in Compounding

The real power of compounding comes with time. The earlier you start, the less you need to invest later.

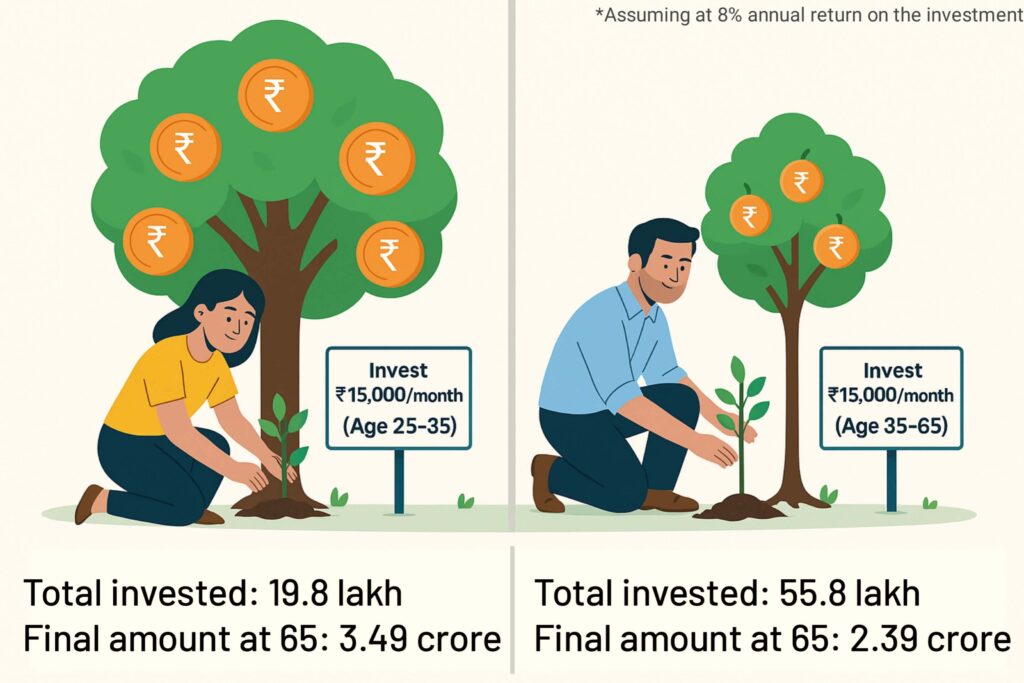

Let’s compare two friends:

Riya invests ₹15,000/month from age 25 to 35.

Kunal starts at 35 and invests ₹15,000/month till 65.

Even though Riya invests for just 10 years and Kunal for 30 years, Riya ends up with more wealth. Why? Her money had more time to grow. That’s the time value of money at work.

Where Can You Use Compound Interest?

Here are some places where compound interest benefits investors:

- PPF (Public Provident Fund): Long-term savings with tax-free returns.

- Mutual Funds & SIPs: Great for medium to long-term investing.

- Fixed Deposits (FDs): Safer option, but returns are lower.

- Recurring Deposits (RDs): Monthly saving habits that use compounding.

- EPF (Employee Provident Fund): Retirement savings with yearly compounding.

Each of these tools relies on reinvesting returns to multiply your money.

What to Avoid

Even though compound interest is your ally, a few missteps can slow you down:

Starting late: The earlier you begin, the more power compounding has.

Skipping contributions: Skipping monthly investments delays your wealth-building.

Withdrawing early: Breaking FDs or withdrawing mutual fund earnings stops the compounding train.

Carrying debt: Credit cards and loans also use compounding, but in reverse. Your debt grows if not paid!

Final Words: Let Compounding Work for You

Building wealth doesn’t require luck, it needs patience and consistency. Use compound interest to your advantage. Start early, stay regular, and let time do the heavy lifting.

The benefits of compound interest over time are not just theory, they are proven. Use online tools like compound interest calculators, choose investments wisely, and avoid impulsive withdrawals.

Start now, no matter how small. Because the secret isn’t just in the money — it’s in the time.

FAQ’S

Use small, consistent actions daily. Save a fixed amount regularly, invest in SIPs, and avoid unnecessary expenses. Like money, positive habits grow over time with consistency.

Simple interest is calculated only on the original principal. Compound interest adds earned interest back to the principal, so you earn interest on interest — resulting in faster growth over time.

You’ll see it in mutual fund returns, fixed deposits, PPF accounts, and even loan interest (in reverse). The longer the money stays invested, the more noticeable the benefit.

Interest earned from compounding is usually taxable based on the investment type. For example, FD interest is fully taxable, while long-term capital gains in mutual funds have lower tax rates after one year.

Higher Frequency = Higher Returns. For example, ₹1 lakh at 8% annual interest compounded monthly earns more than if compounded annually, because interest is added more often.

The standard compound interest formula is:

A = P (1 + r/n)ⁿᵗ

Where:

A = Final amount

P = Principal (initial investment)

r = Annual interest rate (in decimal)

n = Number of times interest is compounded per year

t = Time (in years)

Example, if you invest ₹10,000 at 10% annual interest, compounded yearly for 5 years:

A = 10,000 × (1 + 0.10/1)¹×⁵ = ₹16,105

Key to basics of stock market in 60 minutes