IPO universe

Primary & secondary market

The primary market (New Issue Market) is where a company issues an IPO (Initial Public Offer). Here, the issuer company raises capital directly from investors.

The secondary market sets in after the IPO process has been completed. After the shares are listed on the stock exchange, they are traded publicly. In the secondary market, trading takes place directly between two investors here.

What is an IPO?

Initial Public Offering (IPO) is the process by which a company first issues its shares to the general public in order to raise new funds.

- The issuing company is called the issuer, it may be a new or old company, big or small.

- After an IPO is made available to the public it is then subscribed to by investors.

- The investors give money to the company in exchange for shares.

- The investors in turn expect profits by dividends and capital gains as the price of the stock increases.

Why do companies sell their stock to the general public?

If a promoter of a company requires funds in order to develop the business, they can follow two routes.

- Borrowing funds from a bank or financial institutions and

- Raising funds through issuing shares.

- When a company borrows money from a bank it has to repay the amount along with interest. But,

- When people buy shares, the company receives capital without accepting debt because investors expect returns through growth in the company’s value rather than interest unlike banks.

Example:

Assume that my business is worth ₹20 lakh and I require additional funds to scale up. I am willing to sell a minority stake but do not want to charge interest.

- I decided to offer 10% of the stake to the public for ₹2 lakh.

- To achieve this, I create 20,000 shares with a face value of ₹10 (₹2 lakh divided by ₹10).

- I now offer the 20,000 shares to the public at a higher price of ₹35 per share.

- In this manner, I collect ₹7 lakh from the public in exchange for a 10% stake in my company.

The procedure is more complex in real life, but the principle is the same.

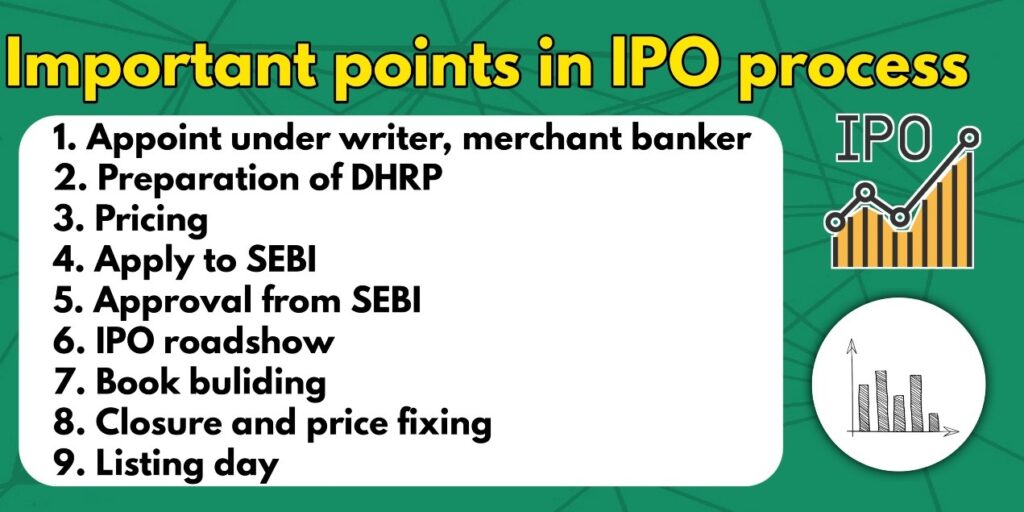

Key points in the IPO process:

1. Engaging a Merchant Banker:

A merchant banker is a financial professional who executes (manages) the IPO procedure on behalf of the company.

2. DHRP preparation:

A Draft Red Herring Prospectus (DHRP) is a document that is released to the public. It include the following information:

- IPO size and estimated shares

- Purpose of funds and timeline

- Business model, revenue structure, financials, risks, and management details

- A warning that the IPO is subject to SEBI approval

This report is subsequently presented to potential investors who are willing to purchase the stock.

3. Pricing:

Two methods can be followed to decide the price of an IPO:

- Price Band Issue (book building issue), Under this system a price band is offered to the investors before the price is finally determined. The price at the bottom of the band is referred to as the floor price, and the price at the upper end is referred to as the ceiling price. The final price is decided on bids.

Suppose the price band is ₹100–₹120; the investors can offer a bid at any price within this range.

- Fixed Price Issue, Here the company decides a fixed price rather than a price band.

4. Application to SEBI for Registration Approval:

The registration statement filed with SEBI provides information regarding the business of the company, motives for coming public and the financial condition of the company.

5. Obtaining Approval from SEBI:

SEBI studies the registration statement, does background checks and then approves or rejects the IPO.

- The company then has to choose a stock exchange where it has to list its shares (in most cases both BSE & NSE).

6. IPO Roadshow:

Includes advertisements to create an awareness of the company and the IPO issue.

7. Book Building:

After the roadshow is over and the price is decided, the company launches the bidding window for the public to subscribe to the shares.

8. Closure and Price Fixation:

Once the book-building window is closed, the listing price is set on the basis of the maximum number of bids received.

9. Listing Day:

This is the day when the company officially becomes listed on the stock market. The listing price is set by market demand and supply on that day.

Subscription Types in an IPO:

Over Subscription:

Oversubscription occurs when the number of shares requested exceeds the number of shares available.

- Example: If 2,50,000 bids are received for 2,00,000 available shares then the issue is considered over subscribed.

Under-Subscription:

If the shares applied for are fewer than the shares offered, it is under-subscription.

- Example: If 1,40,000 bids are received for 2,00,000 available shares, the issue is undersubscribed.

Payment method, ASBA:

ASBA (Application Supported by Blocked Amount) is a compulsory IPO application method adopted by SEBI.

- ASBA blocks the application amount in the bank account of the investor until IPO allotment. In case the application is allotted, the amount is deducted. Otherwise, the blocked amount is released. It ensures quick refunds & better fund security.

Note, When an IPO is oversubscribed then the lottery is employed. For instance, an allotment ratio of 1:4 implies that just one of four applicants is given shares.

IPO Details

- Issue Name: Name of issuing company.

- Issue Type: Fixed Price or Book Building.

- Face Value: Face value of shares.

- Price: Fixed price or price band (for book-building issues).

- Market Lot: Minimum number of shares to buy.

- Minimum Order Quantity: Minimum shares an investor can apply for.

- Listing Exchange: NSE, BSE, or both.

- Issue Size: Aggregate number of shares issued.

Summary

- An IPO (Initial Public Offering) is the process by which a company raises funds by issuing shares to the public.

- companies can raise funds through IPOs rather than borrowing from banks, without having to repay debt.

- Investors subscribe to IPOs with the hope of earning returns in the form of price appreciation and dividends.

- IPO pricing may be fixed price issue or book-building depending on investor bids.

- SEBI oversees IPOs to maintain transparency and safeguard investor interests.

- Subscription can either be oversubscribed (demand is more than supply) or undersubscribed (demand is less than supply).

- ASBA (Application Supported by Blocked Amount) guarantees that the funds of investors are only debited if allotment is made.

Final Note

The stock market may appear to be complicated at first, but once you understand the basics, it opens up unlimited possibilities. Whether it’s IPOs, trading or long-term investment, the key is to stay informed, be patient, and make intelligent choices. Keep learning, keep growing, and let your money work for you!

For more finance-related updates & news, stay connected with FinWhile!