How banks multiply money through credit creation

Have you ever think about how banks make money while also help economic growth? You might be amazed to know that your money does not just sit in vault after you deposit it. In fact, it goes on a travel that benefits many people while also boosting the economy. This process is known as credit creation by bank and it plays a vital role in banking system.

What is credit creation by banks?

Credit creation is the procedure by which banks generate new money for the economy by lending some amount of deposits they receive. This does not mean that banks reprint money. Instead, they make use of deposited funds to give loans, to multiply the total amount of money flow in the economy.

This procedure is based on the concept of fractional reserve banking, in which banks only keep a small percentage of deposits as reserves and lend out the rest.

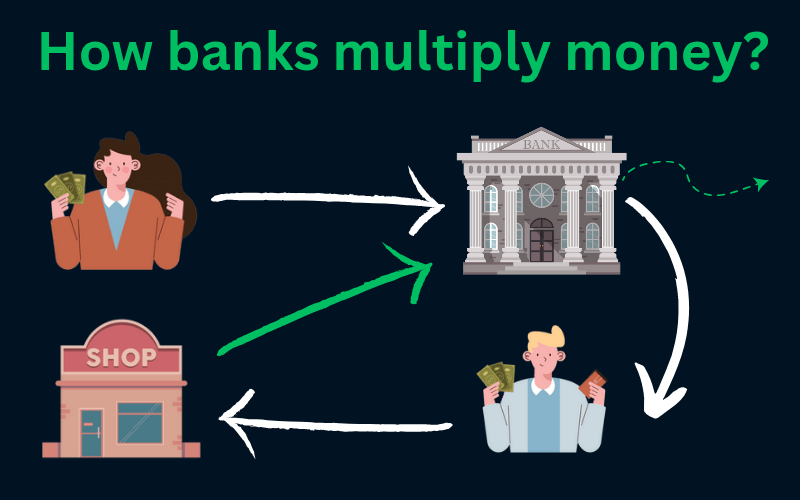

How does the credit creation process work?

Let’s look at a simple story to understand this better.

Step 1: The Initial Deposit

Suppose Priya deposits Rs. 5,000 in her bank account. The bank keeps 10% (Rs. 500) as a required reserve and lends out the remaining Rs. 4,500.

Step 2: The Loan is Spent and Re-Deposited

The bank gives that Rs. 4,500 as a loan to Ravi, who uses it to buy a new laptop from a local electronics store. That store owner, Mr. Shah, deposits the Rs. 4,500 he received into his bank.

Step 3: Re-deposit and Repeat

Mr. Shah’s bank now keeps 10% (Rs. 450) and lends out Rs. 4,050 to another customer. This cycle continues, and eventually, Priya’s original Rs. 5,000 deposit leads to a total of up to Rs. 50,000 in new money circulating in the economy. That’s the money multiplier effect in action.

The Money Multiplier Formula

The maximum money created from an initial deposit depends on the reserve ratio, which is set by the RBI (central bank).

Money multiplier: 1 divided by reserve ratio

If the reserve ratio is 10% [0.1], Money Multiplier will be 1 / 0.1 = 10

This means Priya’s Rs. 5,000 deposit could result in Rs. 50,000 in the economy through repeated lending and re-depositing.

Why Credit Creation is Important

1. Encourages economic growth.

More lending results in increased business activity, which leads to higher employment and income.

2. Encourages spending and investing.

When people and businesses have entrance to credit, they are more likely to fund new opportunities and spend on goods and services.

3. Systematise Use of Idle Funds

Rather than money sitting idle, banks put it to work by lending it to people who need it.

Risks and Regulation

While credit creation boosts the economy, it must be done responsibly. Banks lending too much money without careful monitoring can cause major problems such as:

Inflation: Too much money come after the same amount of goods can lead to price hikes.

Loan defaults: Giving loans to people/businesses who are unable to repay them can harm a bank’s health.

Banking crises: In extreme cases, poor lending operation can cause banks to fail.

To avoid these risks, central bank (RBI) use several regulatory tools.

CRR (Cash Reserve Ratio): This is the percentage of deposits that banks must keep in cash with the central bank. It restrict bank lending capacity.

SLR (Statutory Liquidity Ratio): Banks must hold a percentage of their deposits in safe assets like gold/government bonds.

Repo rate: This is the interest rate at which bank take money from the central bank. Higher interest rates will increase the cost of borrowing and lower lending.

These tools help banks lend responsibly, keep sufficient reserves and maintain trust in the financial system.

Final Thoughts

Credit creation by banks is a powerful engine that drives economic growth. It is amazing how a simple bank deposit can have a ripple effect, sponsoring people’s business, paying salaries or building a home. It all starts with trust and smart banking systems that keep the cycle moving.

Next time you deposit money, remember — it’s not just sitting in a locker. It’s out there working, helping others, and even returning to you in unexpected ways.

FAQ’S

In simple terms, credit creation means repeated lending that increases the money supply. As this process repeats with more deposits and loans, it increases the total money circulating in the economy, even though no new physical cash was printed.

When you deposit money, banks don’t keep it locked away. They lend most of it to borrowers and earn interest on those loans. That’s how they profit, by acting as a middleman between depositors and borrowers

That’s called a bank run, and it can cause panic. But banks will keep reserves and get support from central bank [RBI] to handle sudden demand & it’s very rare

Because it directly impacts your daily life! The interest rates on your loans, the money supply, inflation — all of it ties back to how banks move and multiply money behind the scenes.

yes, through the fractional reserve banking. Banks lend most of what they get and because that money keeps cycling back into the system, it creates more money overall.

Have thoughts or questions about how banks operate? Drop them in the comments below!