Accounts required to trade in the stock market

For the purpose of buying and selling of shares, you should have 3 accounts namely:

- Demat Account,

- Trading Account,

- Bank account.

What is a Depository?

A depository is an entity that allows you to store the share certificates of the stocks you own in a dedicated account known as a Demat account (like a bank locker).

In India, there are currently two depositories that are operational, and they are:

- The National Securities Depository Limited (NSDL) promoted by NSE

- Central Securities Depository Limited (CDSL) promoted by BSE

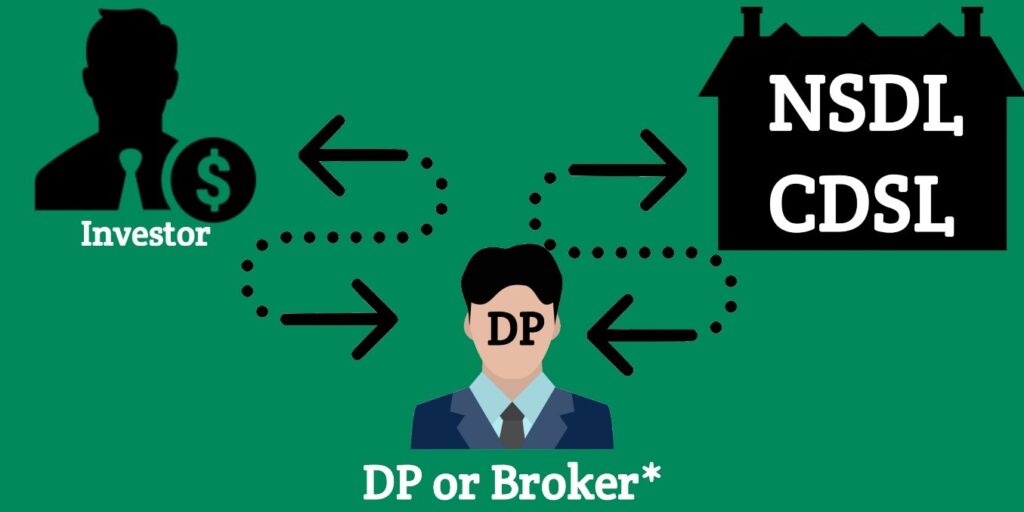

What is a Depository participant(DP)?

A depository participant (DP) is a registered agent who acts as an intermediary between you [investor] and the depository. Your Demat account is held with DP.

- As an investor, you cannot deal with or open a Demat account directly with a depository.

- You’re required to route all your transactions with a depository only through a DP.

- A DP must be registered with SEBI and comply with SEBI norms.

What is a Stockbroker?

A Stockbroker is a SEBI registered intermediary, who connects you to stock exchange [NSE,BSE]

- A trading account is opened with the stockbroker

- You will use the trading account to place buy/sell orders in the market.

- Some brokers act as both Stockbroker and Depository Participant (DP).

Note: not all brokers are not DP’s but most of the brokers are DP’s

However Modern brokers, like Zerodha and Groww(almost all) typically register as both brokers and Depository Participants (DPs).

Generally, all this is taken care of by the broker. So, once you approach a broker, your Demat account, trading account & bank linkage are also opened simultaneously.

Demat Account vs Trading Account

Most people will think Demat and trading accounts are the same but they serve different purposes:

| Feature | Demat Account | Trading Account |

| Purpose | Stores your shares | Facilitates buying/selling shares |

| Function | Acts like a digital locker | Acts like an order placement tool |

How Does Buying and Selling of Shares Work?

Simple example:

- The required money is debited instantly from your bank account linked to the trading account.

- The shares you bought are credited to your Demat account on the next working day (known as T+1 settlement).

T+1 SETTLEMENT:

If you buy shares of any company then money will be deducted from your account instantly, but shares are not allocated to Demat account instantly or on the same day; it take some time it called T+1 settlement [Trade date + 1 working day]

example:

- If you buy shares on Friday:

- Shares will be credited to your Demat on monday (Saturday & Sunday are holidays).

- If Monday is a market holiday, settlement happens on Tuesday.

- Shares will be credited to your Demat on monday (Saturday & Sunday are holidays).

But, You can still sell the shares before you receive them in your Demat, this is called:

- BTST = Buy Today, Sell Tomorrow,

- ATST = Acquire Today, Sell Tomorrow.

Intraday trading

Intraday means buying & selling shares on same day

- There is no settlement done as you buy and sell on the same day.

- The corresponding profit or loss is adjusted in your account.

This is the complete flow, how Accounts & Settlement work when you trade in the stock market.